Back in 2022 there was a post in the ThetaGang subreddit about a Double Diagonal setup:

SPX weeklies 10 delta double diagonal best openinflg (sic) time

i have been playing this strategy for a few weeks in a row and it seems more profitable than IC since given the same spread you get more theta and a tiny, close to 0 vega.

It less profitable than IC if the price stays in the middle, a lot more profitable than IC when closer to the short strikes , but if sold for a credit or for 0 balance

doesn’t come with a loss if IV crushes. If IV spikes a bit is more profitable.Expiration is always friday for the short legs and mondays for the long ones. I close generally half an hour before market close on friday

It sounded like an interesting setup, so I come up with the trade in MesoSim:

This seemed like an interesting trade so I made a backtest: MesoSim Run

Note:

I added an extra rule (exit if delta > 10) to have drawdowns under control.

Without the extra rule it doesn’t perform so well: MesoSim RunI tried a couple of entries during the day and 30 minutes before close was the most profitable (the first link).

Note 2:

Hah! It survived covid crash pretty neatly: MesoSim Run

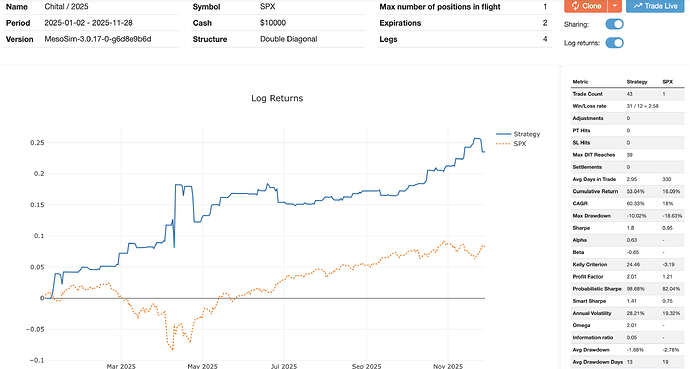

Much to my surprise this trade worked like a hedge during COVID crash. If we rerun it until today (2025-11-28) it continued to hold up reasonably well:

2020 to 2025-11-28 run

It’s 2025 performance is really solid (Sharpe=1.8) and stepped through the april crash.

2025 run

Note on the lucky accident regarding naming:

MesoSim generated the name of ManyChital to the original experiment.

Chital is a type of deer, and deers have two antlers … just like the double calendars.

One can find many more usable trades using Double Calendar or Double Diagonal setup. Feel free to use the Chital as the basis of your exploration. And don’t forget to share your results here ![]()